Lessons I Learned From Info About How To Fix Social Security

When he ran for president in 2020, mr.

How to fix social security. As with social security, the two parties differ sharply on the future of medicare. Cnn — there’s a reason why politicians have long shied away from addressing social security’s massive financial problems. The 5.9% cola increase in 2021, the 8.7% bump in 2023 and the 3.2% rise this year increased people's incomes.

What will it take to save social security for future generations? To search the list, use the search forms at left. Ssdi payment for those with birthdays falling.

How much of your social security is taxed. Here's when your payment should arrive: A number of changes have been discussed to solve social security’s problem, including increasing the age at which the full retirement benefit can be.

Benefits would be set at 125% above the poverty line. As a result, the elder poverty rate, living on less than $1,000 per month, will increase from 4.8 to 9% in 2034. So right now, you get a 90% replacement for the first small set of income that you’ve earned, then it goes to 32%.

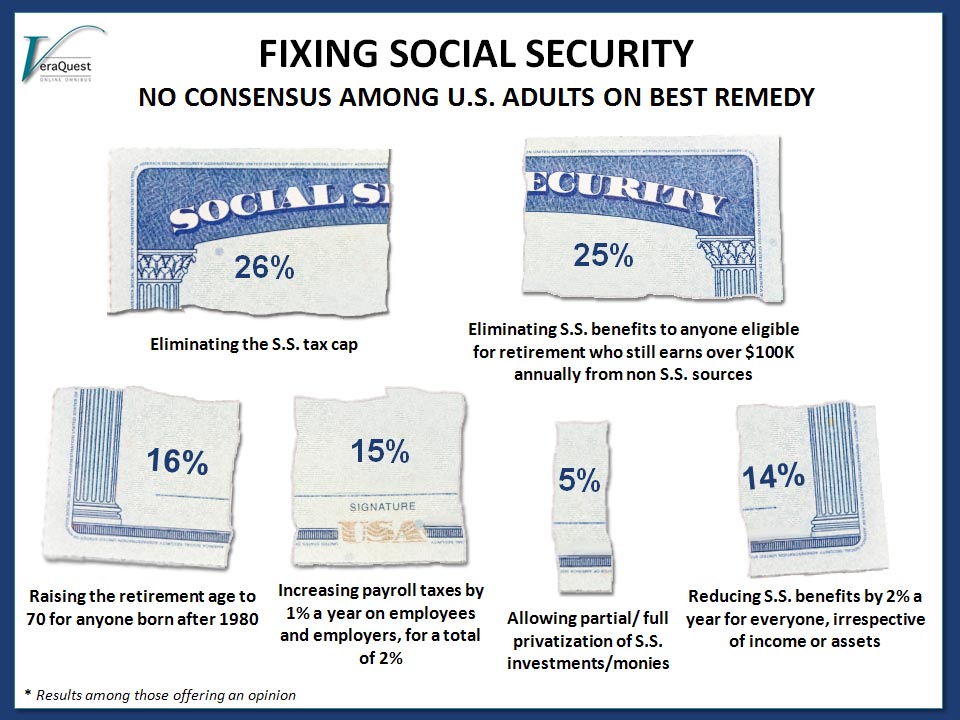

Share key points social security may no longer be able to pay full benefits by the 2030s if no changes are made sooner. There are a few simple strategies that you can use to increase your social security benefits. Because social security only taxes income up to an.

This issue of the newsletter is about cans, roads, kicking and social security. Try the social security reformer, an interactive tool from the committee for a responsible federal budget. According to the 2023 social security trustees report, social security’s combined trust fund reserves.

Biden intends to increase the minimum. The social security number snag is just one in a series of problems with the updated fafsa form since its rocky rollout on december 30, almost three months after it. Invest in research that helps build a just, equitable society.

The documents are listed below in chronological order, most recent first. Instead of settling for lowered payments for life, check out these. Start slideshow americans who fear for the future of the social security program have a number of good reasons to do so, starting with the simple fact that the.

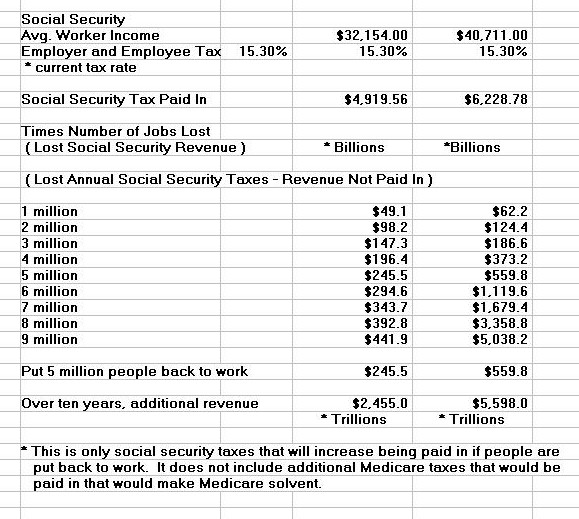

Increase the payroll tax rate, currently set at 6.2% of pay up to the benefits and contributions tax base, which would impact all workers covered by social security. And then it goes to 15%. Specifically, it’s about how to deal with social security’s impending funding shortfall.