Simple Info About How To Start A Small Loan Company

The bottom line.

How to start a small loan company. Let's take a closer look at what goes into starting a microlending business and how we c. Next, you’ll need to register to pay your taxes with the hmrc. There are two particular business models.

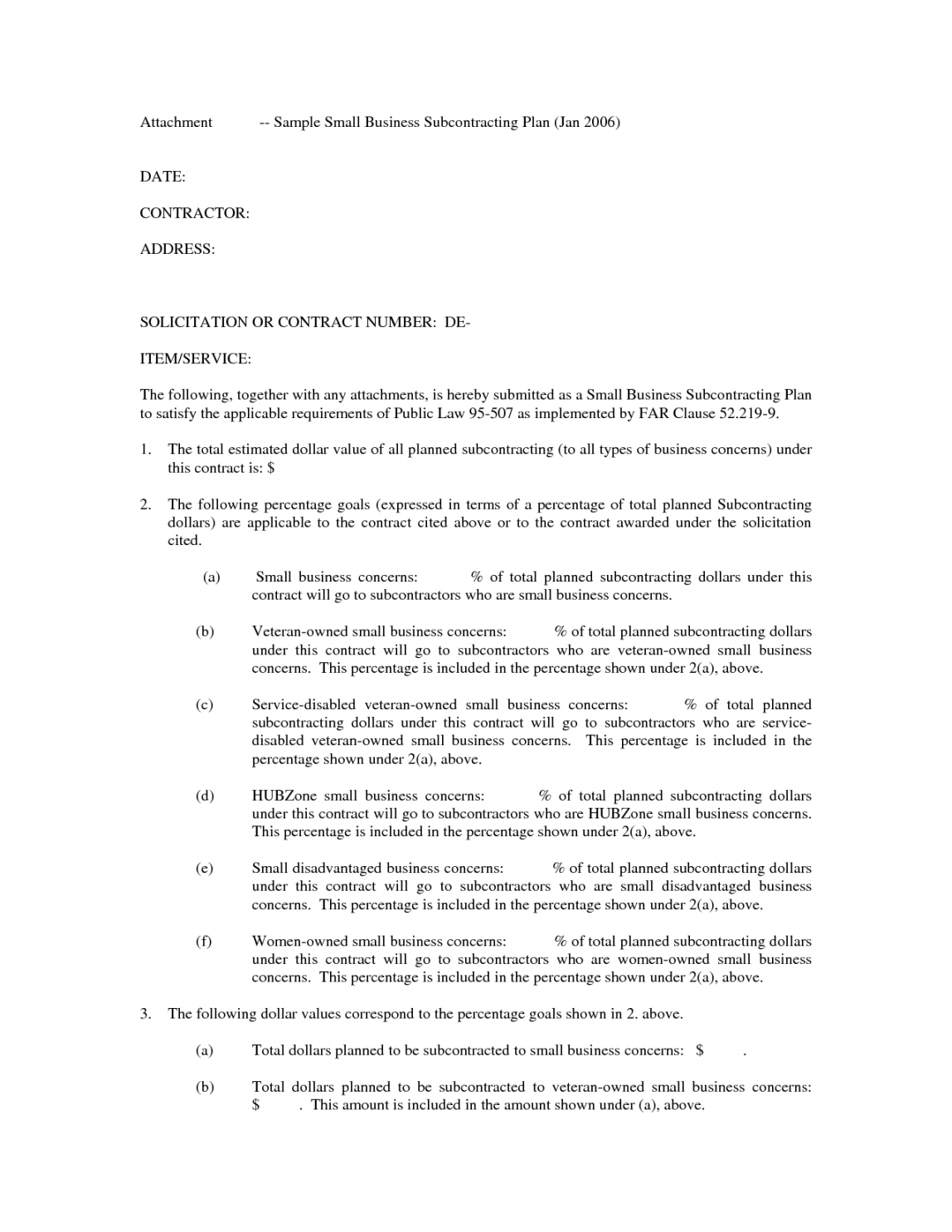

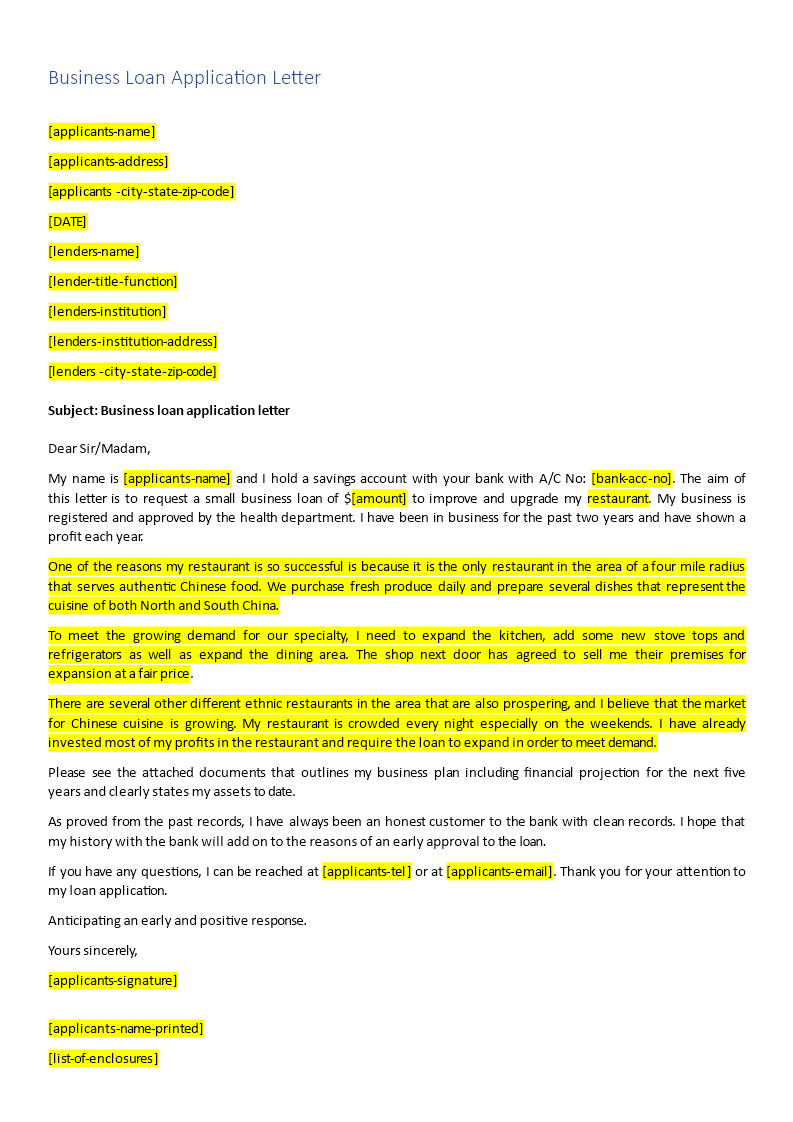

When you apply for a startup business loan, lenders can require a broad range of documents to evaluate whether or. Published september 06, 2023 reviewed by andrew schmidt fact checked by suzanne kvilhaug if you’re hoping to start a business, one of the most profitable is offering. Advertisement sba 7 (a) loans loan amount:

Vary based on lender, but maximums are set based on the prime rate. To apply for a camino financial business loan, begin by. You can buy a franchise for as little as.

Learn the pros and cons, market size, costs, and steps to start a micro. Deciding why you need financing will help you choose the right kind of. A microlending company may operate in one of two ways:

Whether you want funding to start a business or to expand, here’s a list of steps you can take to get started: Buying a franchise can be a great way to start a lending business even if you don't have a massive pile of cash yourself. So, how do i start my own loan company?

Determine how much funding you need. Now that you understand the different types of business loans, here’s how to apply for one: Regardless of the type of loan you’re offering, below are some of the main factors to consider when wanting to.

Determine your business model starting things off on the right foot is crucial to your business’s longterm success. Best fast small business loans. In this video, you will learn how to start a micro lending business.

If you choose to register as a. Best for lower credit scores: Decide why you need financing there’s more than one kind of small business loan.

There is currently no minimum threshold for a personal guarantee to be requested by a lender. However, only 29% of the directors and owners of small. Determine how much funding you need some business owners make the critical mistake of requesting far more funding than they need to get operations up and.

In most cases, lenders want to see at least a year or two in business and a regular income stream. We designed our small business loans with adaptability in mind so they fit your unique entrepreneurial journey. How to apply for a business loan.